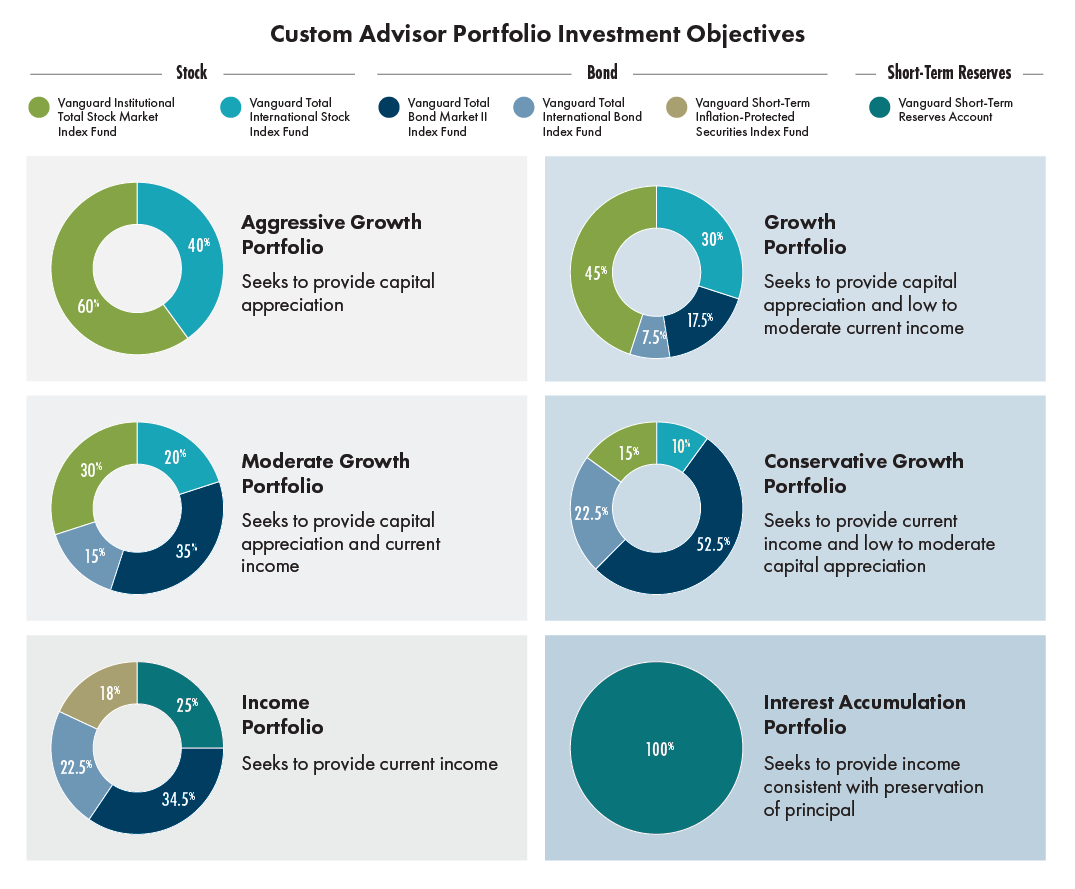

Does your client want to be more involved in their college investments? College SAVE offers six individual portfolios that invest in stocks, bonds, and money market instruments.

This investment path lets you and your clients design your own investment strategy. For example, you might choose to invest in a combination of aggressive and moderate growth when the child is young. Then, as the child nears college, you can move the assets to more conservative investments to help preserve capital and minimize the effects of market fluctuations.

Unlike the target enrollment options, this re-allocation will not automatically occur. The allocation will not change until you instruct College SAVE to change it. You can only move money from one portfolio to another up to two times a year.

The Income and Interest Accumulation Portfolios' investments in Vanguard Federal Money Market Fund are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of the investment at $1 per share, it is possible that the Portfolios may lose money by investing in the fund.

Please note: Participants may make an investment exchange (reallocation) of their existing investments up to two times per calendar year. You can, however, change your allocation for future contributions at any time.

If you need assistance understanding these investments or have any questions, call us at 1.866.SAVE.529.

Ascensus Broker Dealer Services is the distributor of the North Dakota College SAVE plan, Learn more about Ascensus Broker Dealer Services, LLC on FINRA's BrokerCheck.

For more information about North Dakota's College SAVE Plan (College SAVE), call 1-866-SAVE-529 (1-866-728-3529) or click here to obtain a Plan Disclosure Statement. Investment objectives, risks, charges, expenses, and other important information are included in the Plan Disclosure Statement; read and consider it carefully before investing. Ascensus Broker Dealer Services, LLC (ABD) is Distributor of the College Save.

Please Note: Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program. You should also consult your financial, tax, or other advisor to learn more about how state-based benefits (or any limitations) would apply to your specific circumstances. You also may wish to contact directly your home state’s 529 college savings plan(s), or any other 529 plan, to learn more about those plans’ features, benefits, and limitations. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

College SAVE is a 529 plan established by the State of North Dakota. Bank of North Dakota (Bank) acts as trustee of College SAVE Trust, a North Dakota Trust, and is responsible for administering College SAVE Trust and College SAVE. ABD, the Plan Manager, and its affiliates, have overall responsibility for the day-to-day operations of the Plan, including recordkeeping and marketing. The Vanguard Group, Inc. (Vanguard) provides underlying investments for the Plan. The College SAVE's Portfolios, although they invest in mutual funds, are not mutual funds. Units of the Portfolios are municipal securities and the value of units will vary with market conditions.

Investment returns are not guaranteed and you could lose money by investing in College SAVE. Participants assume all investment risks, including the potential for loss of principal, as well as responsibility for any federal and state consequences.

Not FDIC Insured. No Bank, State or Federal Guarantee. May Lose Value.

Vanguard and the ship logo are trademarks of The Vanguard Group, Inc. Upromise is a registered service mark of Upromise, Inc. All other marks are the exclusive property of their respective owners. Used with permission.