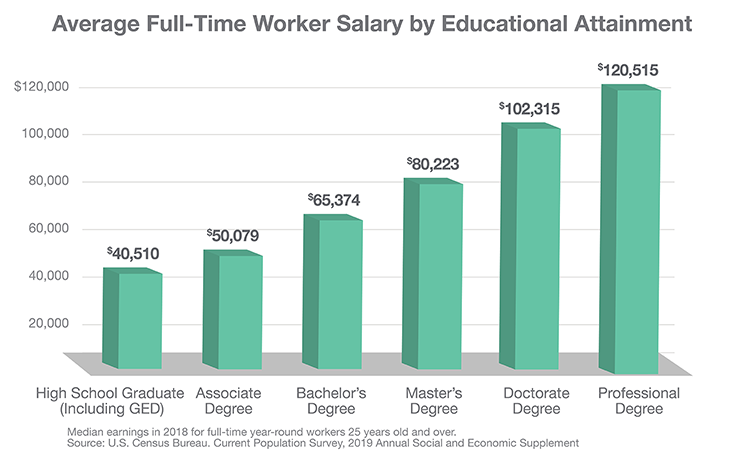

Even with rising tuition rates, there's no doubt that a college education is worth the investment. Bachelor’s degree recipients ages 25 to 34 had median earnings 63% ($19,550) higher than those in the same age range with high school diplomas in 2018. The median family income for those with a Bachelor’s degree or higher earned 52% more than those with a high school education, and those with an Associate’s degree had median earnings that were 26% higher than the high school average.1

But how do families save for college when they're already stretched by mortgage payments, child care, saving for retirement, maybe even caring for aging parents? Many may be tempted to "cross that bridge when we come to it," planning to borrow what's needed, or hoping for scholarships and other aid.

Start early and stick with it.

Contributions to college savings don't need to be large. You can put in as little as $25 a month (less than a family outing). A recurring contribution or payroll direct deposit (if your employer supports it) will let you put your college savings on autopilot.2

As you can see in this hypothetical chart, if an account owner began to save $50 a month when a child was 1 year old (with an initial contribution of $250), a 529 college savings plan could potentially have an account worth $16,494 by the time the child was college age.2

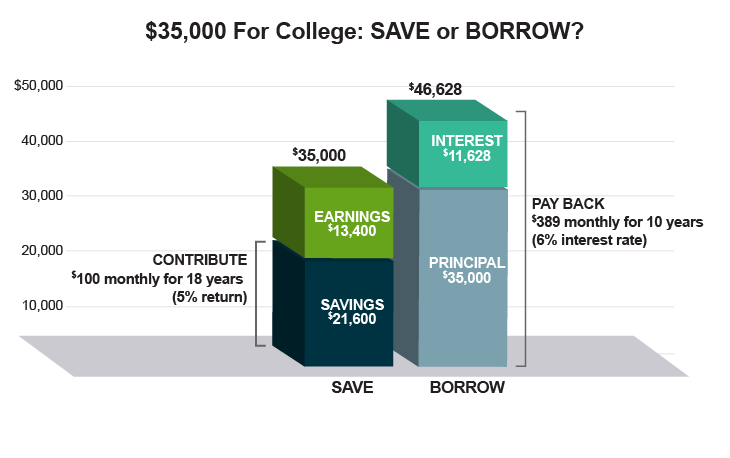

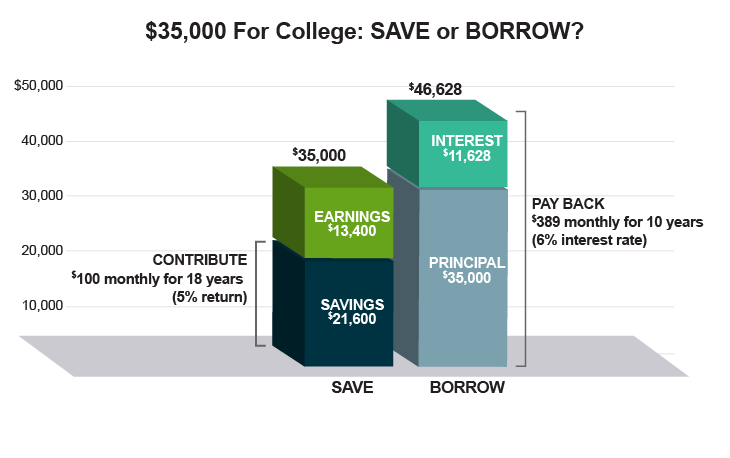

Save now, borrow less later.

With the high cost of college and today's relatively low interest rates, it may seem like a good idea to borrow for college when the time comes, rather than saving money now. Compare these two hypothetical scenarios:

Scenario 1: Terry's parents start investing $100 a month into a 529 plan account right after Terry's birth. In 18 years (assuming a 5% annual rate of return), they could potentially save more than $35,000.3

Scenario 2: After exhausting federal student aid options, Terry has to borrow $35,000 to attend college. Based on a private student loan rate of 6.0 percent, Terry could be faced with a monthly payment of $389 for 10 years (or $46,628).4

Saving pays off for adult students, too.

Today, many adults are going back to school to pursue an undergraduate or graduate degree, or retooling their professional skills at a vocational school or technical institute. More and more of them are taking advantage of a 529’s tax benefits to pay for their adult education.

1College Board: Trends in College Pricing, 2019

2A plan of regular investment cannot ensure a profit or protect against a loss in a declining market.

3The hypothetical example assumes college begins at age 18 and is based on a 5 percent rate of return compounded daily, and is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or taxes, if any, payable upon withdrawal.

4This hypothetical example is for illustrative purposes only and assumes no withdrawals made during the period shown. It does not represent an actual investment in any particular 529 plan and does not reflect the effect of fees and expenses. Your actual investment return may be higher or lower than that shown. The loan repayment terms are also hypothetical. Student loan interest rates could be higher or lower depending on whether or not you take out a federal or private student loan.

Ascensus Broker Dealer Services is the distributor of the North Dakota College SAVE plan, Learn more about Ascensus Broker Dealer Services, LLC on FINRA's BrokerCheck.

For more information about North Dakota's College SAVE Plan (College SAVE), call 1-866-SAVE-529 (1-866-728-3529) or click here to obtain a Plan Disclosure Statement. Investment objectives, risks, charges, expenses, and other important information are included in the Plan Disclosure Statement; read and consider it carefully before investing. Ascensus Broker Dealer Services, LLC (ABD) is Distributor of the College Save.

Please Note: Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program. You should also consult your financial, tax, or other advisor to learn more about how state-based benefits (or any limitations) would apply to your specific circumstances. You also may wish to contact directly your home state’s 529 college savings plan(s), or any other 529 plan, to learn more about those plans’ features, benefits, and limitations. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

College SAVE is a 529 plan established by the State of North Dakota. Bank of North Dakota (Bank) acts as trustee of College SAVE Trust, a North Dakota Trust, and is responsible for administering College SAVE Trust and College SAVE. ABD, the Plan Manager, and its affiliates, have overall responsibility for the day-to-day operations of the Plan, including recordkeeping and marketing. The Vanguard Group, Inc. (Vanguard) provides underlying investments for the Plan. The College SAVE's Portfolios, although they invest in mutual funds, are not mutual funds. Units of the Portfolios are municipal securities and the value of units will vary with market conditions.

Investment returns are not guaranteed and you could lose money by investing in College SAVE. Participants assume all investment risks, including the potential for loss of principal, as well as responsibility for any federal and state consequences.

Not FDIC Insured. No Bank, State or Federal Guarantee. May Lose Value.

Vanguard and the ship logo are trademarks of The Vanguard Group, Inc. Upromise is a registered service mark of Upromise, Inc. All other marks are the exclusive property of their respective owners. Used with permission.